These 3 minute videos break down how health insurance policies and premium tax credits work to help you choose the right plan, make the most of any tax credits you qualify for and avoid risky financial pitfalls.

These 3 minute videos break down how health insurance policies and premium tax credits work to help you choose the right plan, make the most of any tax credits you qualify for and avoid risky financial pitfalls.

Health Insurance Explainer

Deductibles, copays, coinsurance, out-of-pocket maximums and networks. Understanding these basics can help you choose the right plan and use your health insurance with confidence.

Use Connect for Health Colorado’s Estimate and Explore Tool to see which carriers are in-network for your doctors. Always confirm the specific network name with the provider!

Premium Tax Credits Explainer

A practical walk-through of who qualifies, how subsidies reduce monthly premiums, and why where you source your health insurance matters. Avoid costly “gotchas” and get the most bang for your premium dollar.

- Run instant “what if” quotes to see impacts of different income levels on tax credits.

- Federal Premium Tax Credits are NOT available to people eligible for Health First Colorado (Medicaid), Medicare or who have access to affordable coverage through their or a spouse’s employer

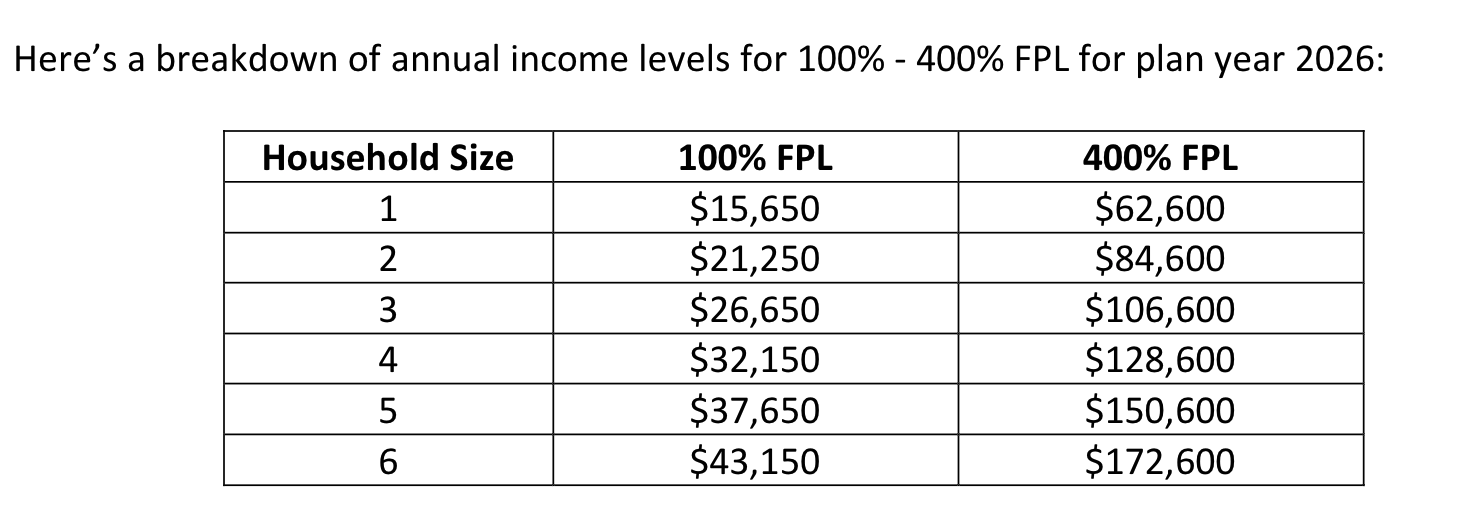

- In 2026, Federal Premium Tax Credits are NOT available to people whose income is below 100% or above 400% of the Federal Poverty Level:

- Federal Premium Tax Credits are based upon your tax household’s Modified Adjusted Gross Income (MAGI). MAGI is your Adjusted Gross Income (AGI), plus any tax-exempt foreign income, tax-exempt Social Security benefits and tier 1 railroad retirement benefits, tax-exempt interest. However, MAGI excludes Supplemental Security Income (SSI).

- Adjusted Gross Income (AGI) – Generally appears on IRS Form 1040 on line 11.

- Adjust your estimate for any changes you expect like raises or financial windfalls.

- Report income and household changes on your Connect for Health Colorado marketplace insurance application as soon as possible. If you don’t, you could wind up with the wrong amount of savings or even the wrong insurance plan.

- Get the latest news update on 2026 ACA tax credits in Colorado.

HSA Plan Masterclass

Learn how to save money with HSA qualified health insurance plans while gaining the benefit of 100% tax free savings via Health Savings Accounts.

See HSA Contribution Amounts and see what types of medical, dental and vision care is HSA qualified.

Colorado Health Insurance Brokers does NOT provide tax guidance. Consult with a qualified tax professional for any tax-related questions.

More Resources:

How to make a payment for a new ACA plan after you enroll